You’ll also pay to renew your registration every one, two or three years.

There are also registration fees, documentation fees and taxes that you’ll pay when you purchase the car. If you’re unsure of how much to budget, visit to view the fuel economy or gas mileage and projected annual fuel costs for the year for the make and model of the vehicle you select. Use Edmund’s car maintenance calculator to get an estimate of how much you’ll spend to maintain your vehicle.įuel expenses are another cost to keep in mind as you search for a new vehicle. Make sure you understand car insurance rates and the best car insurance companies available in order to select the best car insurance coverage for your needs.Īlso, consider maintenance and repair costs, which can start at around $100 per visit but vary by the make and model of your vehicle. What are other important car ownership costs to consider?īeyond the cost of monthly car loan payments, vehicle ownership costs can add up.Ĭar insurance is one of the more significant costs that come with owning a vehicle. Speaking directly to a loan officer is also a great way to gather and compare a few options. This way they can tell you expected rates with your credit history in mind.

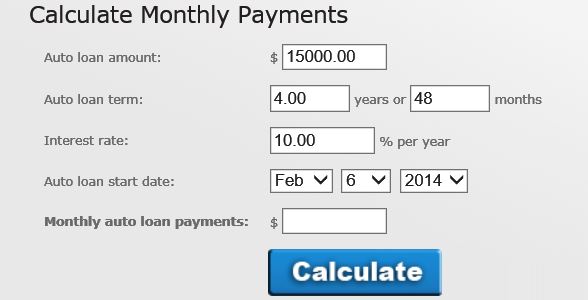

Bankrate auto loan calc full#

Bankrate’s auto loan calculator will present you with your estimated monthly payment, total interest paid and a full amortization schedule. Use an auto loan calculator. If you are looking for a simpler route to avoid any mental math, an auto loan calculator will handle all the calculations.The resulting number will be how much your interest payment for the month is. Divide your interest rate by the number of payments in a year, then multiply it by your loan balance. Calculate on your own. You will need the interest rate, term and loan amount, just as you would for any other method.Here are a few ways that you can calculate your car loan interest rate. Not only will it put you in control of your finances, but it can ensure that you don’t end up paying more interest than you should. It’s smart to determine your expected auto loan interest rates prior to signing off on your next loan. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.ī is an independent, advertising-supported publisher and comparison service. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey.īankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our experts have been helping you master your money for over four decades. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our goal is to give you the best advice to help you make smart personal finance decisions. Our editorial team does not receive direct compensation from our advertisers.īankrate’s editorial team writes on behalf of YOU – the reader. We maintain a firewall between our advertisers and our editorial team.

Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens.

What to do when you lose your 401(k) matchīankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Should you accept an early retirement offer? How much should you contribute to your 401(k)?

0 kommentar(er)

0 kommentar(er)